Accountancy Advisory Salary Insights 2023

Author: Patrick Bell

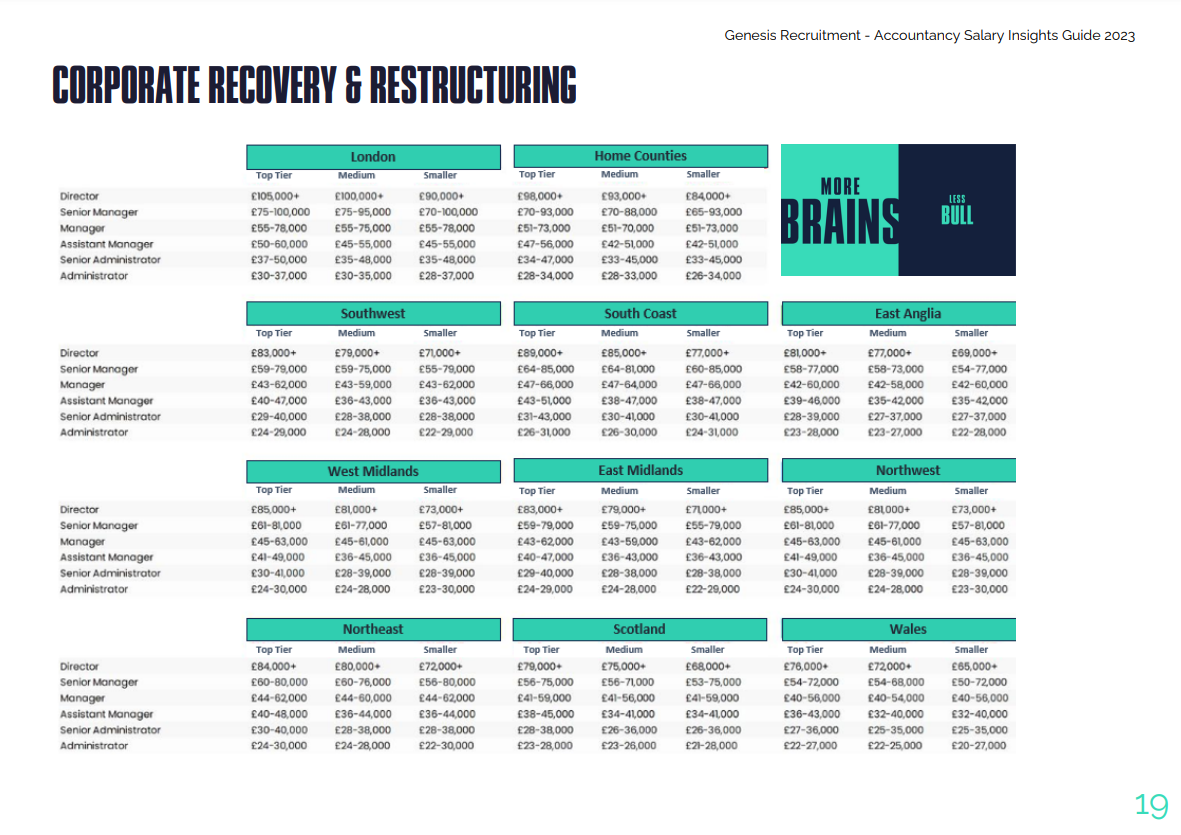

FORENSIC ACCOUNTING

In the realm of forensic accounting, the demand for hiring has remained relatively steady over the past year, albeit with a notable emphasis on dispute-related matters as opposed to

investigations. This trend can be attributed in part to the mounting economic pressures faced by individuals and businesses alike. As financial strains persist, it wouldn’t come as a surprise to witness a potential surge in both personal and

corporate fraud cases. This, in turn, is expected to lead to an increased workload in forensic investigations.

However, the challenges in the field of forensic accounting extend beyond just demand. The legal system, already grappling with a backlog of cases, is likely to face further delays in processing forensic matters. Commercial disputes, triggered

by breaches or contract terminations, typically become more prevalent in an economic downturn. Moreover, with the previous boom in business sales, we can anticipate a rise in disputes

stemming from Share Purchase Agreements (SPAs).

The aftermath of COVID-19 continues to cast a shadow over the forensic market, with a particular focus on insurance claims. Unfortunately, there’s no sign that this aspect of the forensic landscape is going to ease anytime soon.

One noteworthy shift in the industry is the dwindling presence of mixed or hybrid forensic accounting roles. As the field becomes

increasingly specialized, these roles have become a rarity. For candidates transitioning from other disciplines without prior forensic experience, this presents a formidable early career challenge. The days of being a forensic generalist seem

numbered, and individuals in mixed roles or those seeking to switch disciplines must do so before accumulating two years of post-qualified experience.

In summary, the world of forensic accounting faces a multifaceted set of challenges, ranging from the evolving nature of demand, legal system delays, and the impact of economic downturns to the disappearance of mixed roles and the need for

early career specialization.

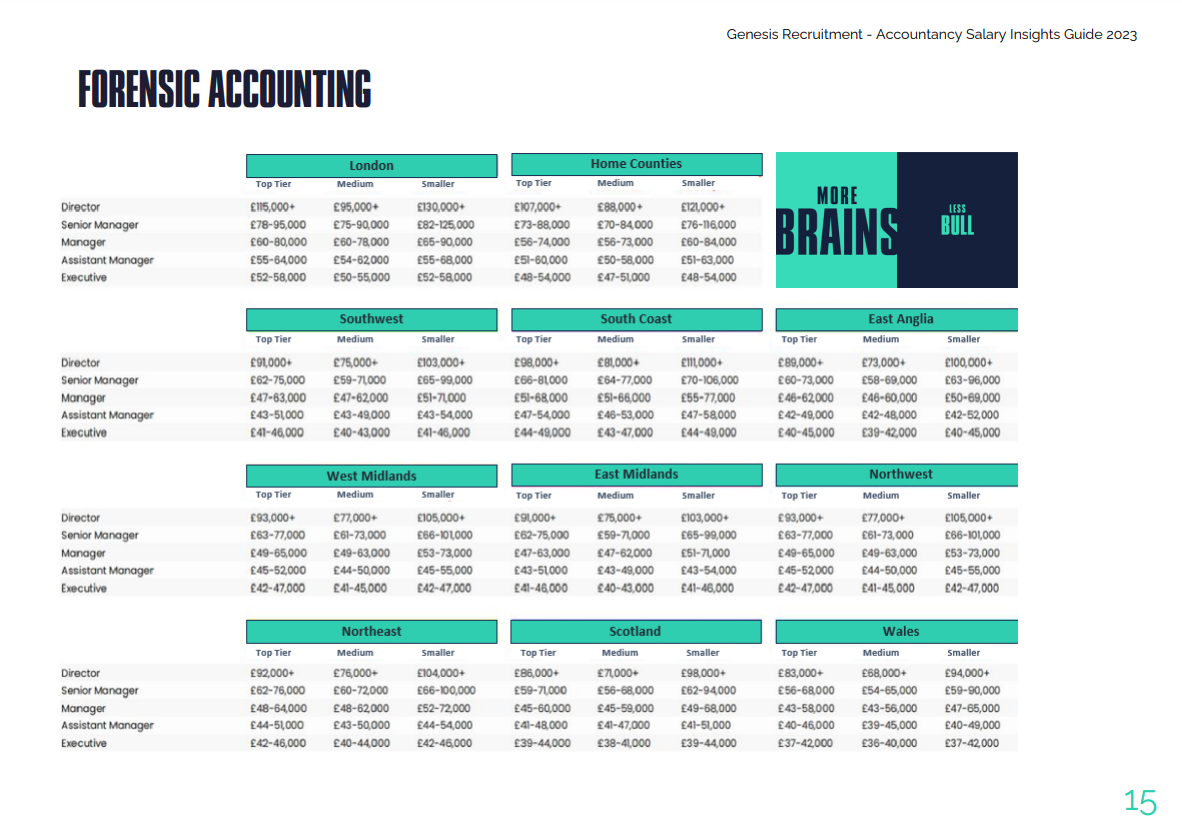

CORPORATE FINANCE

Over the past couple of years, the surge of private equity investment flowing into the accountancy practice realm has been nothing short of remarkable. The pace of consolidation has been

astonishing and is fundamentally reshaping the landscape of the practice market.

There has been a much larger appetite of OMBs seeking an exit in 2022 and in 2023, perhaps the covid scare and economic turbulence have accelerated many exit strategies. This coupled with significant reserves in the private equity sphere, have really shaped the landscape. It certainly feels like a seller’s market, with numerous consolidators and larger firms actively seeking to acquire multiple firms within a short timeframe.

Some of these deals have proven to be ideal fits for both parties, while others appear to be driven by a desire for rapid growth to meet turnover targets. However, it’s worth noting that the merger and acquisition (M&A) market has seen a notable

decline in activity compared to the post-lockdown highs. Increasing debt costs have subjected deals to more intense scrutiny, and the pace of transactions has decelerated as a result.

The UK, with its negative economic outlook, has experienced a more significant drop in M&A activity compared to many other countries. Nevertheless, as we move into 2023 with a more

optimistic outlook, we anticipate a resurgence in deal-making. Mid-market firms have managed to weather the storm reasonably well and have continued their recruitment efforts. However, attracting corporate financiers from larger firms or

candidates whose deal sizes align with their client base, unlike those from investment banks, has proven to be a challenge.

Conversely, larger firms and consultancies have shifted their focus towards areas such as performance improvement and value creation, diverting their attention from traditional corporate finance. As we look ahead, the second half of the

year is likely to bring a surge in activity, leading to recruitment needs across firms at various levels. The demand for talent is expected to intensify rapidly in a market that was already relatively constrained in terms of candidate availability.

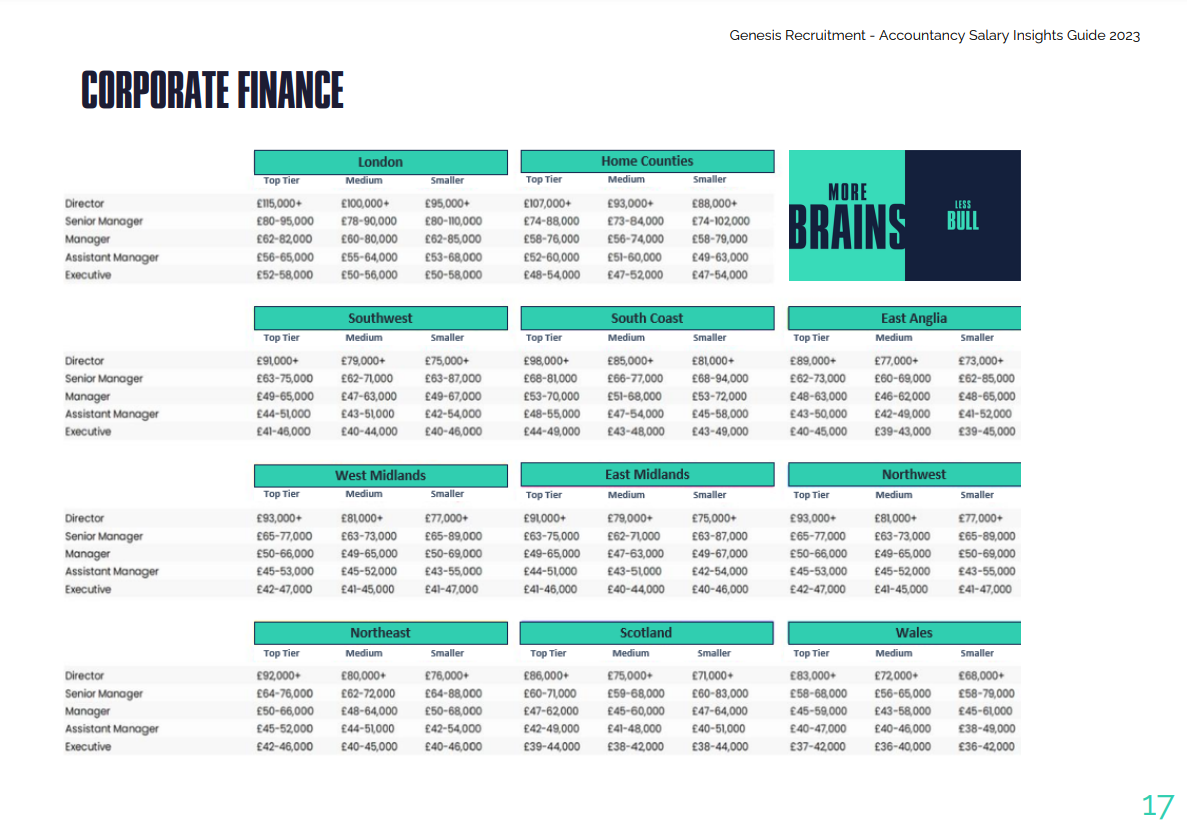

CORPORATE RECOVERY & RESTRUCTURING

In 2023, the corporate recovery and restructuring industries, including insolvency practices, have witnessed a mixed performance. While these sectors have seen increased activity

due to the lingering economic impacts of the COVID-19 pandemic and evolving market conditions, they have also faced certain recruitment challenges.

The corporate recovery and restructuring industries have been more active as businesses grapple with financial difficulties stemming from the pandemic. Companies have sought these

services to navigate insolvency, restructure debt, and strategize for recovery. With the uptick in activity, there has been a surge in

demand for experienced professionals who can handle complex restructuring and insolvency cases. This includes licensed insolvency practitioners, legal experts, and financial analysts with expertise in these areas.

The corporate recovery and restructuring sectors are highly regulated, and professionals in these fields must stay up-to-date with ever-evolving laws and regulations.

This adds another layer of complexity to recruitment, as firms seek candidates with a strong understanding of compliance and legal intricacies.

Despite the demand, recruiting top talent has been challenging. Experienced professionals in this field are relatively scarce, and competition for their skills is fierce. Attracting individuals

with the necessary expertise to manage intricate financial restructurings has been a consistent hurdle.

The adoption of technology and data-driven solutions has become increasingly important in the corporate recovery and restructuring industries. Firms are looking for professionals

who are not only well-versed in traditional methods but also proficient in leveraging digital tools for more efficient and effective processes. Economic uncertainty and market volatility have played a significant role in shaping the recruitment landscape. The potential for sudden shifts in market conditions adds a layer of unpredictability to these industries, impacting

both hiring decisions and recruitment planning.

Author: Patrick Bell

Patrick works for businesses and individuals that need to identify Accountancy Practice professionals in General Practice, Audit, Tax, Corporate, Advisory. North West UK

email: pbell@genrec.co.uk

Connect: https://www.linkedin.com/in/genesispb/

Forensic Salaries 2023

Corporate Finance Salaries 2023

Recovery & Restructuring Salaries 2023